There are some exciting money-saving programs available for Texas homeowners looking to upgrade their current HVAC system to a new more energy-efficient heat pump in 2023. Updates to the Inflation Reduction Act (IRA) further incentivize homeowners to make energy-efficiency upgrades to their home by installing high-efficiency heating, cooling, water-heating equipment, and more. The largest credits and rebates are available for heat pumps, a high-efficiency system that heats and cools your home in place of a traditional air conditioner and furnace. When coupled with cleaner electricity sources, a heat pump can be a sustainable way to control the temperature indoors. Here is everything you need to know about heat pumps, IRA Tax Credits, Home Electrification and Application Rebate (HEAR) program, the Whole House (HOMES) rebate program, and whether you qualify.

What are Heat Pumps?

Heat pumps are a type of HVAC equipment that provides both heating and cooling for homes and buildings. They work by transferring heat from one location to another, rather than generating heat through the combustion of fossil fuels like natural gas or oil. In the warmer months, a heat pump pulls heat from the inside of your home and moves it outside. In the colder months, the process is reversed, collecting heat from the outdoor air and moving it indoors. This makes heat pumps an energy-efficient and environmentally friendly alternative to traditional HVAC systems.

One of the main benefits of heat pumps is their energy efficiency. Because they rely on the transfer of heat rather than the generation of heat, they use significantly less energy than traditional heating and cooling systems. This can result in substantial energy cost savings for homeowners and building owners, especially in climates where heating and cooling are required for much of the year.

Heat pumps also have a number of environmental benefits. Because they use less energy and do not rely on the combustion of fossil fuels, they produce fewer greenhouse gas emissions than traditional heating and cooling systems. This can help to reduce the overall carbon footprint of a home or building and contribute to the fight against climate change.

Heat pumps are very versatile, as they can be used to heat and cool both homes and commercial buildings. They can be used in a variety of climates, including both cold and hot climates, and can be an effective alternative to traditional heating and cooling systems in both cases.

Texas Heat Pump Tax Incentives

The Inflation Reduction Act (IRA), signed in August 2022, includes nearly $370B dedicated to climate and energy programs. This includes $690 million to Texas for the State Energy Conservation Office (SECO) to implement and administer these programs. The IRA includes a substantial increase in limits and an extension of the already popular Energy Efficiency Home Improvement Tax Credit (25C). Previously, there was a lifetime limit of $500/per taxpayer, this has now been replaced with an annual limit. This means you have a limit for each year, but you can now claim energy improvements on your home year over year. With the 2023 updates the IRA now provides for an annual credit of 30% of the project’s cost, and up to a $2,000 annual limit for a qualifying heat pump.

Texas HEAR Heat Pump Rebate

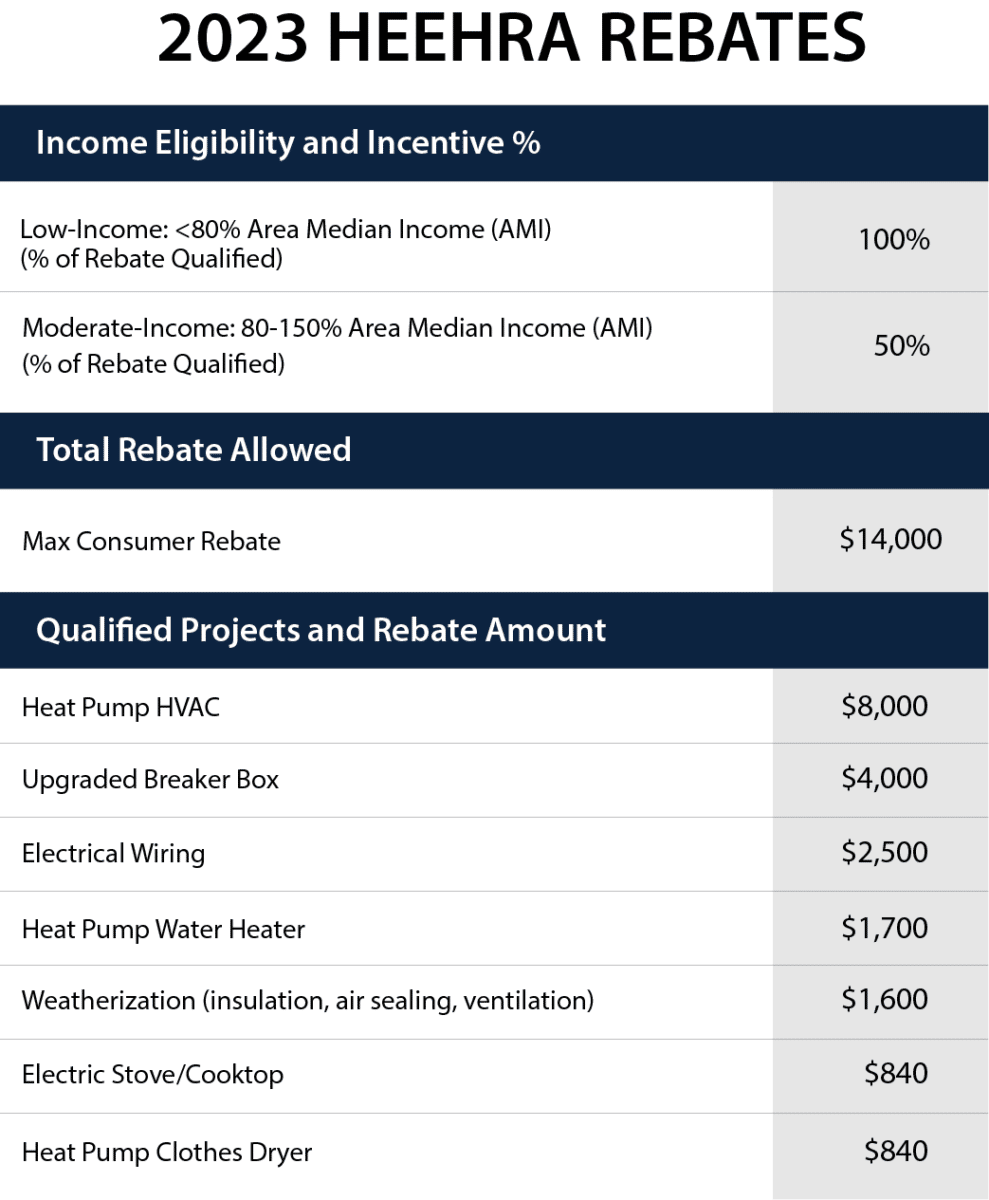

Additionally, the updated IRA includes an exciting new rebate program known as the Home Electrification and Application Rebate (HEAR) program aimed at providing instant savings to homeowners looking to purchase energy-efficient upgrades for their homes. The HEAR program will help Texas families save money on their monthly energy bills, create healthier indoor air environments, and reduce carbon emissions. The HEAR rebate provides up to $14,000 to Texan homeowners to cover various costs to electrify homes in low-income and moderate-income households. Ready for even more great news? The HEAR program can stack with federal energy efficiency and electrification tax credits! That means you can receive the HEAR rebate and still take advantage of claiming the IRA tax credit.

2023 HEEHRA Program Requirements

- If your household income is less than 80% of your area’s median income, you’re eligible to receive the maximum rebate of $8,000 for a new heat pump.

- If your household income is 81-150% of your area’s median income, you’re eligible to receive up to 50% of the maximum heat pump rebate.

- If your household income exceeds 150% of your area’s median income you aren’t eligible for the HEEHRA rebates but can still receive a 30% tax credit of up to $2,000 on a new heat pump.

You can look up your Area Median Income using this AMLI Lookup Tool

HOMES Rebate Program

The HOMES rebate program incentivizes whole-home retrofits in both single-family and multifamily dwelling units. Efficiency rebates are available to households of any income level, but rebate amounts are doubled for low- and moderate-income households. For the HOMES program, the rebate amounts will be determined based on energy savings using either a modeled or measured savings method. The modeled savings pathway will provide a rebate amount based on the estimated energy savings particular to a home at the time of the retrofit installation. The measured savings pathway will calculate rebates based on the actual energy savings after a certain period following the installation of the retrofit.

There has never been a better time to upgrade your HVAC system to a more energy-efficient model. Call us today at (972) 217-8955 to get a free quote for installing a heat pump for your home.

Sign up for our newsletter to stay up to date with the latest information regarding this program as it is released.